Chapter Outline

- 1. Existing Solutions - The complex, lengthy journey of traditional audiobook production

- 2. Ideal Customer Profile - Understanding our target authors and their characteristics

- 3. Total Addressable Market - Market size, growth projections, and TAM calculation

- 4. Real Opportunity - Market gaps and expansion potential for AudioFlo

1. Existing Solutions

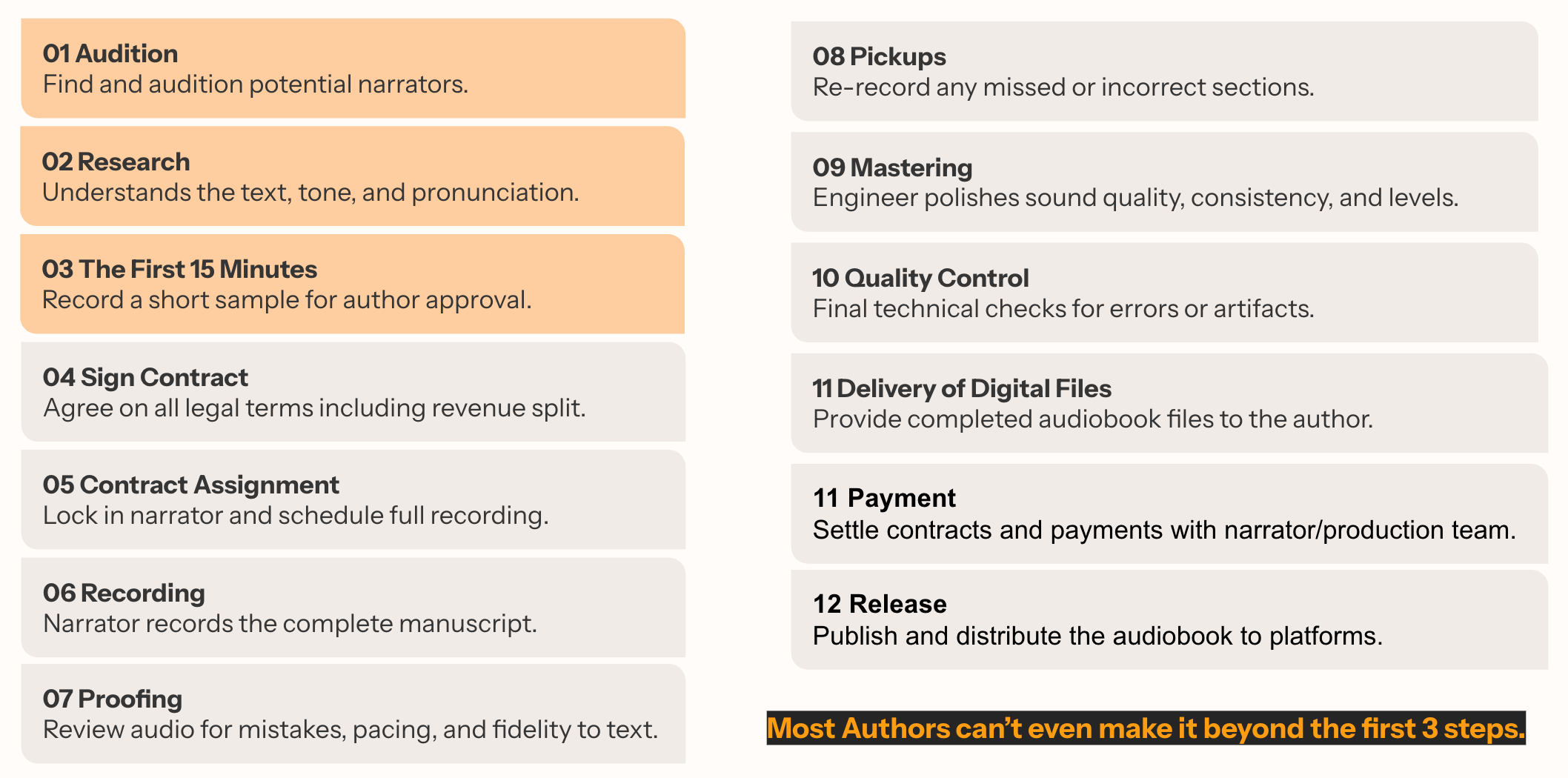

Most authors remain unaware of the complexity and lengthy timeline involved in audiobook production until they experience the process firsthand. The traditional production pipeline involves manuscript preparation and casting (2-4 weeks), studio recording sessions (1-3 weeks for a standard book), extensive post-production editing including mastering and quality checks (2-4 weeks), and finally distribution setup across multiple platforms, a journey that typically spans 2-3 months minimum.

Beyond the timeline, authors face three major challenges: the prohibitive costs ranging from $150-500 per finished hour, the technical expertise required for audio engineering and platform specifications, and the difficulty of finding and vetting the right narrator whose voice aligns with their book's tone and audience.

Figure 1: A complex and lengthy journey for audiobook production

The process becomes even more overwhelming when considering the extensive coordination required between multiple stakeholders. Authors have to manage ongoing communication with narrators, production managers, and audio engineers, each with their own schedules and priorities. This creates significant overhead through endless email chains, revision cycles when pronunciations or character voices need adjustment, and unexpected delays when any party encounters issues. Authors often describe feeling like project managers rather than creative professionals, spending more time coordinating logistics than focusing on their next book.

2. Ideal Customer Profile

During my interviews with 24 self-publishing authors, a clear profile emerged of who AudioFlo serves best. These weren't just statistics, they were real people with real frustrations about audiobook production.

The typical AudioFlo customer is Sarah, a fantasy novelist from New York who has published three books in her series. She's built a loyal readership of 1,200 followers across social media and email, but she's constantly hearing the same request: "When will this be available as an audiobook?"

Sarah represents our core customer profile:

The secondary profile includes established authors seeking to reduce production costs and timelines. They may have produced audiobooks before through traditional methods but are now eager to explore innovative solutions for more control and efficiency.

3. Total Addressable Market

The audiobook industry isn't just growing-it's exploding. When I first researched this market in late 2024, even I was surprised by the scale of opportunity.

Global Market Size

The global audiobook market reached $8.7 billion in 2024, with the United States accounting for $2.2 billion of that total. This represents a compound annual growth rate of 20% over the past five years, making audiobooks one of the fastest-growing segments in publishing.

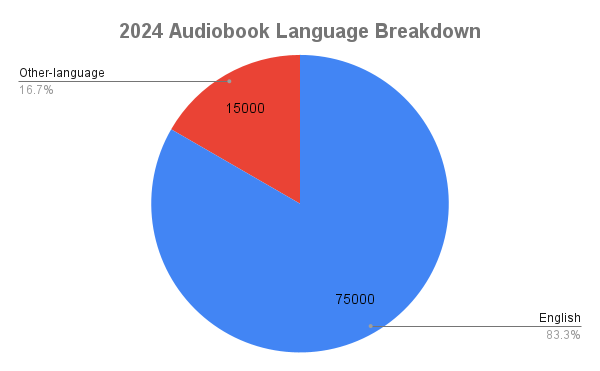

Language Distribution

English-language audiobooks dominate the market, representing approximately 75,000 new titles published annually compared to 15,000 titles in all other languages combined. This concentration creates a massive addressable market for English-language content creators.

Figure 2: English dominates the audiobook market with 83% of titles published

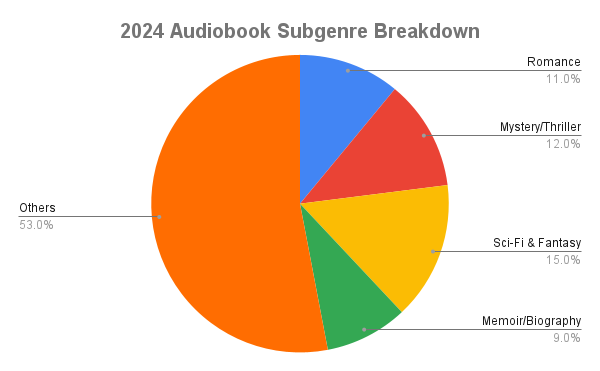

Genre Breakdown

Fiction dominates audiobook consumption at 64%, with romance, mystery/thriller, and sci-fi/fantasy leading the categories. Non-fiction accounts for the remaining 36%, primarily driven by memoir/biography and business/self-help content.

Figure 3: Fiction leads audiobook consumption at 64%, with romance and mystery/thriller as top genres

TAM Calculation

To understand AudioFlo's true market opportunity, I analyzed the audiobook market through progressive filters that match our ideal customer profile:

| Step | Filter | Market Revenue | Assumptions |

|---|---|---|---|

| Global Audiobook Revenue (2024) | - | $8.7B | APA, global consumer spend |

| English-language content | 75% | $6.525B | Based on title distribution |

| English-speaking countries | 80% | $5.22B | US, UK, Canada, Australia, etc. |

| Self-published share | 15% | $783M | Conservative, includes ACX, Findaway |

| Authors with series | 60% | $469.8M | Series dominate indie revenue |

| Author share of revenue | ~40% | $188M | After platform fees (e.g., 60% kept by Audible/ACX) |

Table 1: TAM calculation filtering from global audiobook market to AudioFlo's addressable segment

This $188 million represents the actual revenue that self-published series authors receive after platform fees, our direct addressable market. But this only tells part of the story.

Market Projections

The audiobook market is exploding with demand increasing by 26% annually. This growth translates directly to expanding opportunities for content creators:

Creator-Side TAM Growth (2024-2029)

Figure 4: Self-published audiobook creator revenue projected to reach $597M by 2029

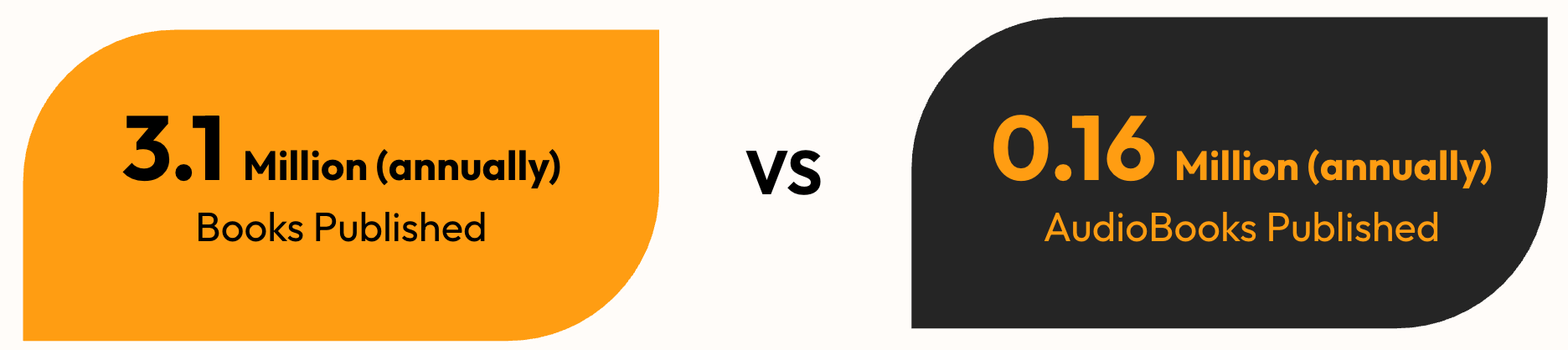

4. Real Opportunity

Figure 5: The audiobook conversion gap - only 8% of books have audio versions

The Market Gap

The real opportunity lies in market expansion:

- Over 3.2 million self-published books are released annually

- Less than 5% of these become audiobooks due to cost and complexity barriers

- If AudioFlo captures just 1% of this underserved market, that represents 17,000 potential customers

- At an average customer lifetime value of $200, this translates to a $3.4 million annual opportunity in the first year alone

The total addressable market extends beyond current audiobook producers to include the vast majority of authors who have been priced out of audio altogether. AudioFlo isn't just competing for the existing $188 million creator-side market, we're creating access to an entirely new segment of content creators who couldn't afford traditional audiobook production.